In a drab meeting room of San Francisco's city hall this week,Brigitte Meyer the city's leaders briefly confronted a brave, new world.

Robots will upend the very nature of work and further concentrate wealth among their owners, said Supervisor Jane Kim, who's seen as a progressive in a city without a single elected Republican.

It's time to consider taxing them.

"We must start redirecting a small percentage of these new profits to retrain and then re-employ human beings that are being replaced by these machines," Kim said, calling for a hearing on the matter.

Elsewhere in the city, that future doesn't seem so far off. Sleek delivery bots are gliding along sidewalks at a local permit rate of $66 per block, and driverless cars are back on the streets after a scuffle over a $150 state license.

This Tweet is currently unavailable. It might be loading or has been removed.

Kim may have been simply grandstanding about something in the headlines, as politicians are wont to do. The fact remains, though, that governments will probably have to grapple with some of these questions sooner rather than later.

Her proposal was a reaction to some buzzy comments made by Bill Gates during an interview last month.

The billionaire philanthropist told Quartz a tax on automated machinery would slow the incoming wave of worker displacement by keeping people competitive with their sub-human counterparts. It would also compensate for the massive loss in income tax revenues governments would see if everyone were out of work.

Economists and policy wonks have spent the weeks since debating how crazy this notion is. Some have gone so far as to call Gates, the guy who ran the biggest tech company of his time, a Luddite.

Among his circle of billionaire friends, Gates seems to be alone in his opinion at the moment. But others in Silicon Valley are similarly worried about the shock wave their big ideas might soon cause the labor market, and thus the fabric of society.

Elon Musk, Marc Andreeson, Facebook co-founder Chris Hughes, Ebay founder Pierre Omidyar and Y-Combinator head Sam Altman have all rallied around a universal basic income -- a program in which the government regularly pays every citizen a fixed sum -- as a possible fix. A robot tax could conceivably fund that vision.

One would think that such an imposing business burden might chafe at the worldview of some of those techno-libertarians, however.

Musk might talk a big game about basic income -- which appeals to the libertarian vision of a pared-down social state -- but when it comes to the tax that might supplement and bankroll it, he has a duty to Tesla shareholders to oppose it, for one thing.

The chief criticism of the robot tax is that it would hamper the innovation needed to drive the economy. New technology helps keep the economy growing, and its current rate is already lower than many economists would like.

To this, Gates essentially refers to the lessons of a basic economic textbook. Taxes should be set incrementally in a way that minimizes worker displacement while maximizing growth -- the same push-and-pull approach used for most public constraints on capitalism.

In this case, gradually leveling the tax will help ease the sharp impact of displacement, which Gates says will probably come in devastating bursts as each new technological advance is adopted. Some economists have cosigned this prescription.

Former U.S. Treasury secretary and Harvard economist Lawrence Summers claims the proposal would lead down a slippery slope. It's too hard to determine the net social benefit of each new piece of technology, he says -- some displace workers but others, like ATMs and word processors, make things more efficient for everyone. One could even argue that vaccines reduce jobs for medical workers, he says.

This Tweet is currently unavailable. It might be loading or has been removed.

Like most slippery-slope arguments, however, this view operates in a theoretical vacuum that ignores the particulars of reality. In his original interview, Gates argues that taxes can be targeted judiciously at industries harmed the most at any given time.

“Okay, what about the communities where this has a particularly big impact?" Gates suggests regulators should ask. "Which transition programs have worked and what type of funding do those require?”

The country may be barreling towards one of those aforementioned bursts of job loss.

City delivery bots and self-driving Ubers are one thing, but it's America's heartland that will likely suffer the most from the next wave of automation.

There are approximately 3.5 million truck drivers in America, according to the American Trucker Association -- it's the most common job in more than half of the country's states.

It's also one of the last middle-class jobs that doesn't require a college degree, and many of those who do it live in rural areas that have been ravaged by the loss of factory jobs in recent decades.

A huge number of these people could be out of work within the next decade. Companies like Uber-owned Otto are already working towards unmanned big-rigs. A convoy of them recently journeyed across Western Europe.

Original image has been replaced. Credit: Mashable

Original image has been replaced. Credit: Mashable All but three of the states in which trucking is the biggest job voted for Donald Trump last November. Yet the problem has never featured in a presidential tweet or rally speech, despite Trump's supposed economic populism.

And given the Trump administration's general aversion to regulations and taxes, a sweeping public toll is probably not in the cards.

Moreover, most of these states also have Republican governors eager to attract business investment.

Trump's transportation secretary, Elaine Chao, did however pay lip service to the problem recently, without offering much concrete detail on a potential solution.

“As a former secretary of Labor, I am very, very concerned about that and very cognizant of those challenges," she said, according to Politico. "So we do have to transition people and we need to keep that in mind."

A recent study from the McKinsey Global Institute estimates that about half of all the world's jobs could be replaced by technology that exists now or is currently being developed. That's around $16 trillion in lost wages.

The good news is that the report estimates that this change will happen at a much slower pace than other forecasts predict. It's not just about developing the technology -- many other estimates ignore the time it takes for the market to make it feasible for wide-scale adoption, the researchers say.

The number is also by no means universally accepted. A study by the OECD last year pegged the portion of jobs replaced in developing companies in the next 20 years at as low as 9 percent.

Still, the overarching conclusion is that the march of technology is more or less inevitable.

This Tweet is currently unavailable. It might be loading or has been removed.

As other studies show, the shift will mostly benefit the rich.

Meanwhile, the United States currently has one of the highest corporate tax rates of any developed country, though Trump has promised to cut it from 35 percent to 15 percent.

Even so, the share of federal taxes paid by corporations has been in a general decline since the 1950s.

Because of offshore tax havens and other loopholes, the U.S. Government Accountability Office found that between 2008 and 2012, the average corporation effectively paid around 15 percent less than the set rate -- profitable corporations paid an even lower amount -- and two thirds of companies paid no income tax.

Even if a robot tax were politically viable, the chances of getting the biggest companies to pay it are uncertain.

Like many regulatory ideas considered radical in this country, a robot tax has already been proposed in Europe. But European Union legislators shut it down last month because of many of the same criticisms mentioned above.

A robot tax makes for appealing headlines, but it really just amounts to a tax on a specific type of capital -- the non-labor physical means by which businesses produce things.

There are other policy tools through which governments can effectively redistribute the growing portion of wealth concentrated in capital and preserve jobs, but they wouldn't necessarily generate the same public interest as stories involving a big-name mogul and a suggestion of a futuristic dystopia.

The first step is acknowledging the problem.

In the microcosm of San Francisco, fancy new high-rises and tech riches haven't stopped the famously left-leaning city's politicians from tangling with Silicon Valley, though they've had mixed success. The city has a unique spot on the forefront of both progressive politics and technology.

As such, it tends to be ground zero for a lot of the clashes between tech and government that spread throughout the rest of the country.

Perhaps robot regulation may be one of the next fights.

Trump signs AI education order to train K

Trump signs AI education order to train K

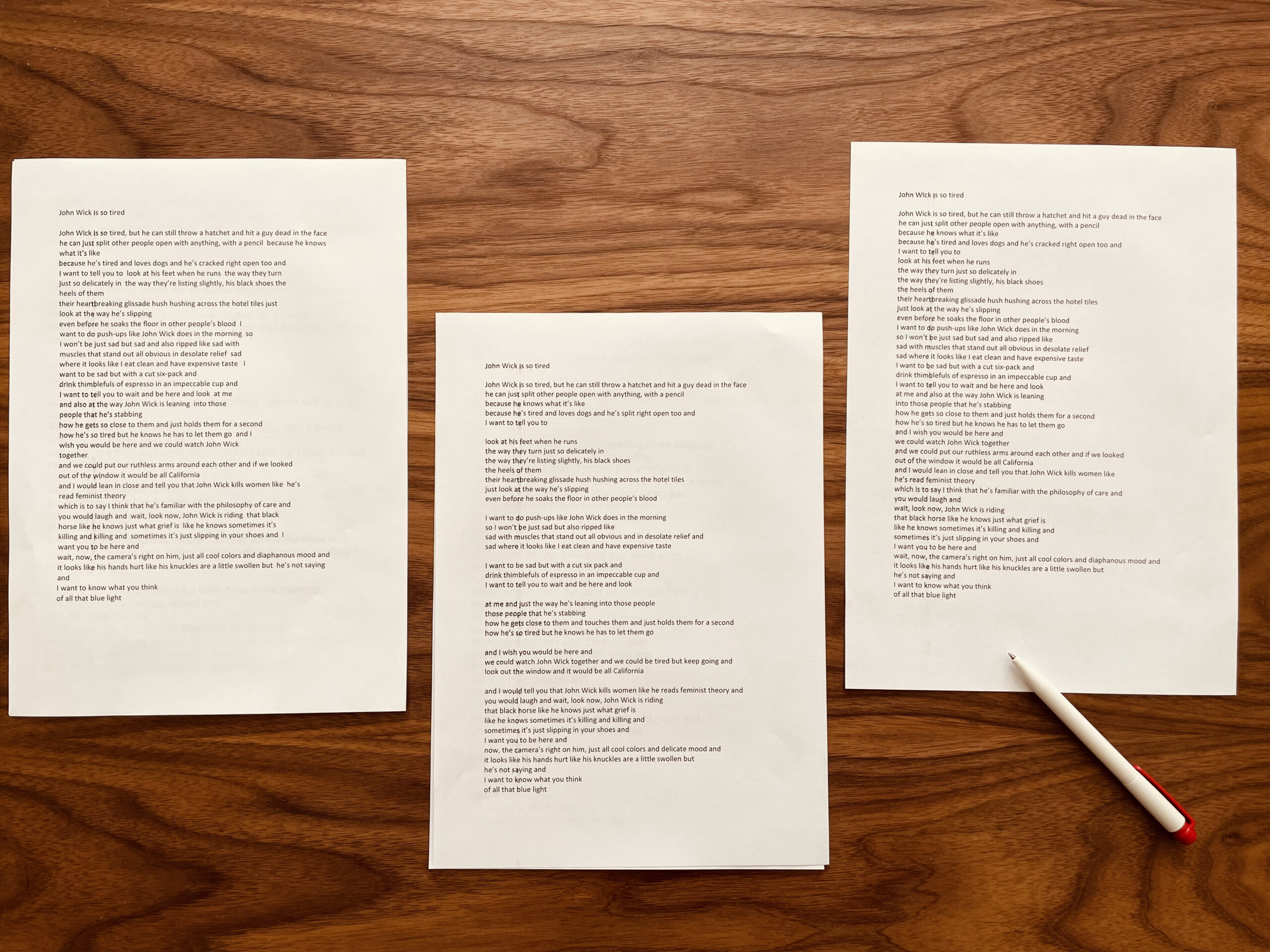

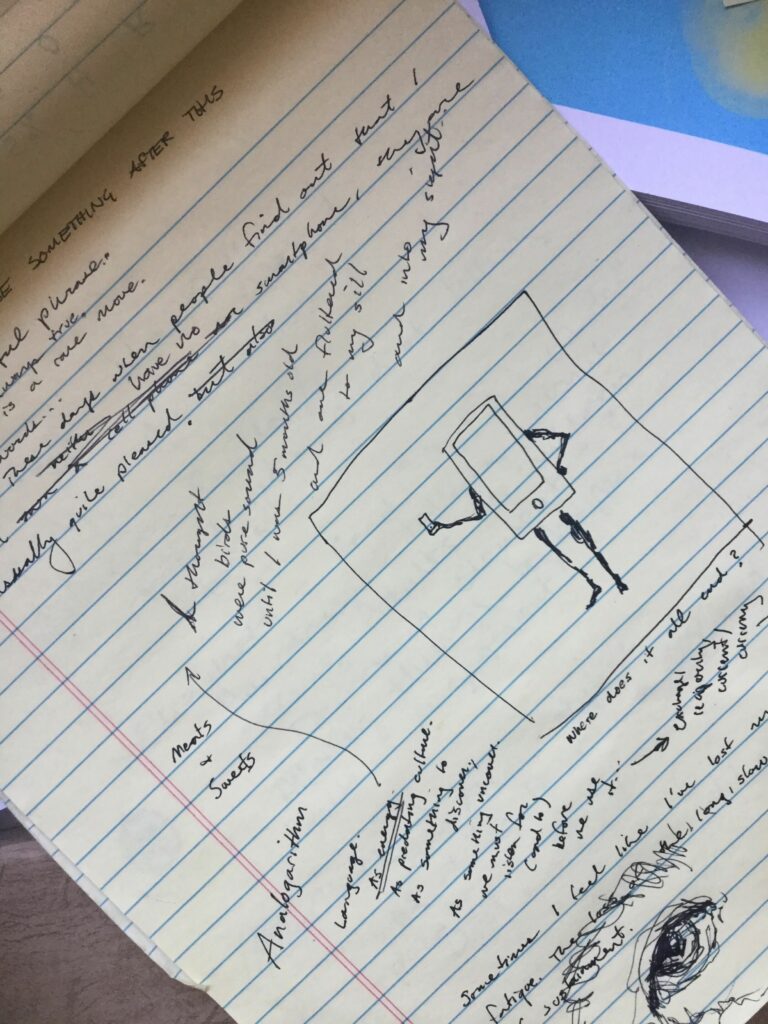

John Wick Marathon by The Paris Review

John Wick Marathon by The Paris Review

Nancy Lemann Recommends The Palace Papers and Loyola’s Spiritual Exercises by Nancy Lemann

Nancy Lemann Recommends The Palace Papers and Loyola’s Spiritual Exercises by Nancy Lemann

For Black History Month, TikTok honors creators and announces new grant partnership

For Black History Month, TikTok honors creators and announces new grant partnership

Best Samsung Frame deal: Free Music Frame with Frame Pro art TV purchase

Best Samsung Frame deal: Free Music Frame with Frame Pro art TV purchase

The Review’s Review: Don Carlo and the Abuse of Power by Krithika Varagur

The Review’s Review: Don Carlo and the Abuse of Power by Krithika Varagur

Dear Mother by Colm Tóibín

Dear Mother by Colm Tóibín

Elon Musk's Neuralink has implanted a brain chip in a human for the first time

Elon Musk's Neuralink has implanted a brain chip in a human for the first time

Lucky rocket just left Trump's America behind

Lucky rocket just left Trump's America behind

Making of a Poem: Kyra Wilder on “John Wick Is So Tired” by Kyra Wilder

Making of a Poem: Kyra Wilder on “John Wick Is So Tired” by Kyra Wilder

Making of a Poem: Michael Bazzett on “Autobiography of a Poet” by Michael Bazzett

Making of a Poem: Michael Bazzett on “Autobiography of a Poet” by Michael Bazzett

Best home security deal: Get the eufy Security

Best home security deal: Get the eufy Security

Best iPhone deal: Save $147 on the iPhone 15 Pro Max

Best iPhone deal: Save $147 on the iPhone 15 Pro Max

What to do with an old laptop

What to do with an old laptop

On Paper: An Interview with Thomas Demand by Olivia Kan

On Paper: An Interview with Thomas Demand by Olivia Kan

On Mary Wollstonecraft by Joanna Biggs

On Mary Wollstonecraft by Joanna Biggs

Trump nominee pledges to shield NOAA climate scientists from intimidation, censorship

Trump nominee pledges to shield NOAA climate scientists from intimidation, censorship

University apparel emblazoned with 'CUM' is a chaotic internet mysteryUniversity apparel emblazoned with 'CUM' is a chaotic internet mysteryFacebook is actively deleting shares of 'The Daily Stormer' article on Heather Heyer'Little Hope' conjures witchy best for new Dark Pictures game: ReviewWhat to do when you really want to use a group shot on TinderCan you name the 3 branches of government? This meme offers up some, uh, creative answers.How @YesYoureRacist became the internet's fastest tool to identify white supremacistsVery excited dad nails insane frisbee golf shot. Son doesn't care.Mischievous pup who found the wrong side of the law is still a very good dogThe Gap's hilariously bad unity sweatshirt accidentally unites people who hate itThe best 2020 political moments from late nightThis Handmaid's Tale cast video reminds us to create changeGoogle cancels The Daily Stormer's domain registration just hours after GoDaddy warningExtremely excited pup just can't wait to catch the bus to doggy schoolGoogle lists Halloween 2020's most popular costumesNo matter who wins the election, you still have to care about politicsRobocalls, WeChat messages, and more spread misinformation on Election DayThis guy's amazing Tinder profile is a PowerPoint sales pitch5 things to know if you want to become a single parent by choiceGaming chat app shuts down alt It's Prince George's first day of school and aww he looks so nervous These stock photos put rescue animals center frame The Galaxy Note can't come to the phone right now. Why? It's pretty much dead. Chris Evans sums up the difference between Barack Obama and Donald Trump in one satisfying tweet New York City schools will now offer free lunch to every kid who wants it Everything coming to Hulu in January 2021 Sesame Street reveals new Rohingya refugee muppets Guy drops iPhone out of plane, iPhone survives, takes video of entire ordeal She threw her poop out the window. Then her Tinder date really went off the rails. How to see the Christmas star: The "Great Conjuction" is about to appear This was the year TV figured out technology. Finally. Twitter reemphasizes retweets after quote tweets didn't work as hoped Latest iOS update shows all the ways Facebook tracks you. There are a lot. Rush Limbaugh's hurricane diatribe highlights just how dangerous right The 20 best tweets of 2020 Prince Harry and Meghan Markle are getting royally into podcasts with Spotify Apple to Facebook: We're standing up for our users YouTube and Gmail are down (Update: And they're back) Spatial’s new AR meeting app might save you from the Zoom grid of doom Trump says Ivanka calls him 'daddy,' and he likes it

2.2801s , 10155.8359375 kb

Copyright © 2025 Powered by 【Brigitte Meyer】,Steady Information Network